Energy Critical Elements

Articles

Robert Jaffe, Jonathan Price, Murray Hitzman, and Francis Slakey

[A recent report prepared under the auspices of the APS Panel on Public Affairs and the Materials Research Society examined the roles and availability of various “energy critical elements” (ECS’s) – elements that will be crucial in the development and commercialization of new ways of producing, distributing, and conserving energy. This article is based on the report, which can be found in its entirety at the APS website. See also “The Back Page” of the April 2011 edition of APS News – Ed.]

Introduction

A number of chemical elements that were once laboratory curiosities now figure prominently in new technologies like wind turbines, solar energy collectors, and electric cars. If widely deployed, such inventions have the capacity to transform how we produce, transmit, store, or conserve energy. To meet U.S. energy needs and reduce dependence on fossil fuels, novel energy systems must be scaled from laboratory, to demonstration, to widespread deployment.

Energy-related systems are typically materials-intensive. If new energy-related technologies are to become widely deployed, the elements required by them will be needed in significant quantities. However, many of these elements are not presently mined, refined, or traded in large quantities, and as a result their availability may be constrained by many complex factors. An element may be “energy-critical” for a variety of reasons: It may be intrinsically rare or unevenly distributed in Earth’s crust, poorly concentrated by natural processes, currently unavailable in the U.S., found in concentrations that do not allow for economic extraction, or produced in a small number of countries or in locations subject to political instability. A shortage of these energy-critical elements (ECEs) could significantly inhibit the adoption of otherwise transformative energy technologies, which would in turn limit the competitiveness of U.S. industries and the domestic scientific enterprise. Recently there have been several efforts to identify critical minerals that are both essential to our economy and subject to supply restrictions [1,2,3,4].

In response to growing concern to these issues, the Panel on Public Affairs of the APS and the Materials Research Society (MRS) established in late 2009 a committee to examine the situation and make recommendations. The 14 members of this committee, which was co-chaired by Robert Jaffe and Jonathan Price, have expertise in physics, geology, materials science, energy economics, and science policy. In this article, we review current uses and supply issues for a number of ECE’s, and summarize the committee’s recommendations for a coordinated set of government actions to facilitate smooth and rapid deployment of desirable technologies. It is sobering to realize that The United States relies on imports for more than 90% of its supply of the majority of ECEs identified in the APS/MRS report.

While we do discuss here particular ECEs and their applications, we emphasize that the report focuses on identifying commonalities and addressing potential constraints on ECEs rather than on attempting to construct a definitive list of ECEs, which will doubtless change with time as technologies, supply lines, and risk factors change. Our report did not consider national defense matters, nor did we consider elements like beryllium that are critical for defense but which do not have prominent energy-related applications.

Energy Critical Elements: Uses and Sources

A present-day list of ECEs would begin with the rare-earth elements (REEs). These include lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), ytterbium (Tb), and lutetium (Lu). The closely related elements scandium (Sc) and yttrium (Y) are often included as well. While promethium, holmium, erbium, and thulium are rare-earths, we do not include them in our list as promethium is unstable and the others have no energy-critical uses at present. Although the U.S. led the world in both production and expertise on REEs into the 1990s, over 95% of these important elements are now produced in China, which is rapidly putting the U.S. and other importers at great disadvantage.

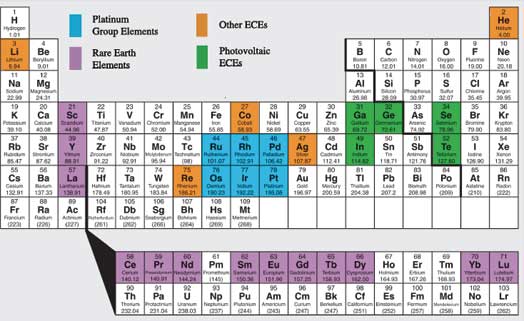

To the rare earths we add the platinum group elements (PGEs) ruthenium (Ru), rhodium (Rh), palladium (Pd), osmium (Os), iridium (Ir), and platinum (Pt). Additional ECE candidates include gallium (Ga), germanium (Ge), selenium (Se), indium (In), and tellurium (Te), all semiconductors with applications in photovoltaics. Finally, cobalt (Co), helium (He), lithium (Li), rhenium (Re) and silver (Ag) round out the list. Our list of ECEs is highlighted in the periodic table in Figure 1.

Figure 1. Periodic table highlighting energy-critical elements. The selection of ECEs would have been different in the past and no doubt will be in the future.

These elements are used in a wide variety of technologies. Gallium, germanium, indium, selenium, silver, and tellurium are all employed in advanced photovoltaic solar cells. Dysprosium, neodymium, praseodymium, samarium and cobalt are used in high-strength permanent magnets for energy-related applications such as wind turbines and hybrid automobiles. Lithium and lanthanum are used in high performance batteries. Helium is required in cryogenics, energy research, advanced nuclear reactor designs, and manufacturing in the energy sector. Platinum, palladium, and other platinum-group elements as well as cerium are used as catalysts in fuel cells that may find wide applications in transportation. Rhenium is used in high performance alloys for advanced turbines.

In the following paragraphs we highlight a few particular examples of situations that can affect ECE availability. This is by no means intended to be an exhaustive list.

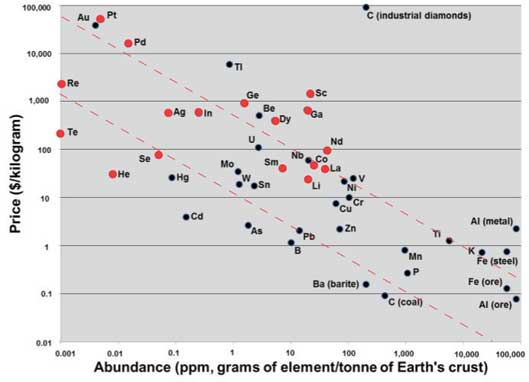

Germanium is an example of an element that is constrained in its availability because it is not appreciably concentrated by geological processes. While not particularly scarce (it is twenty times more abundant than silver; see Figure 2), it rarely forms minerals in which it is a principal component, and is produced primarily as a by-product of zinc extraction. In 2010, the USGS reported global production of Ge in 2009 from zinc refining to be 140 metric tons (MT), of which 71% came from China. For comparison, 2009 production of Zn was 11,100,000 MT, of which 25% came from China, the world’s leading Zn producer.

Figure 2. Elemental prices vs. crustal abundance. ECEs are highlighted in red.

Among the ECEs, the rare earths, platinum group elements, and lithium are perhaps most vulnerable to geopolitical risks. Platinum production, for example, is concentrated in the hands of a small number of companies in South Africa, which produced 79% of the world’s supply in 2009. Also for that year, both South Africa and Russia each produced about 41% of the world’s production of palladium (195 MT).

Like germanium, tellurium is an example of an ECE that is now obtained as a by-product of the mining of another element, but the situation for it is exacerbated by lack of information. No ores are mined primarily for their Te; essentially all of it comes from refining of copper. Because Te production is so small (about 200 MT in 2009) compared to that of Cu (15,800,000 MT in 2009), there is little incentive to maximize Te recovery from Cu processing even though Te costs considerably more than Cu ($145/kg vs. $5.22/kg in 2009). Tellurium is used in photovoltaic panels, and we estimate that some 400 MT of Te will be required per gigawatt of produced electric power. Predicting the capacity of supply to expand to meet a significantly increased demand for Te is difficult: data on rates of recovery of Te from Cu ores are not available, little is known about the geological and geographic variability of Te in Cu ores or the extent of Te abundance in other sulfide ores, and even less is known about the existence, extent, and reserves of primary Te deposits.

Lithium is an example of an ECE whose future supply in the marketplace is experiencing significant uncertainty associated with delays in production and utilization. As the principal component in one of the most promising forms of high energy-density batteries, many believe Li batteries are the technology of choice for all-electric vehicles. But if electric vehicles are to gain a significant share of the market, Li production must grow. However, there are other materials that could be considered for use in high performance batteries. The choice of which battery technology to develop depends largely on the availability and price of the component materials. Ramping up production of Li from existing mines and developing new ones is not a trivial matter, nor is the design of batteries suitable for all-electric vehicles. Lacking a clear decision on the fundamental battery design, it is not surprising that exploration for and development of new Li supplies remains in limbo.

Rhenium is an example where intrinsic rarity can affect supply: it perhaps the rarest of all naturally occurring, stable chemical elements. In 2006, General Electric (GE) realized that demand for Re, a critical material in its turbine engines, was increasing significantly, with worldwide demand predicted to exceed supply by 2011. GE made a decision to reduce the company’s reliance on Re with a strategy that includes both recycling and R&D of substitute materials; this approach enabled them to reduce their use of Re while buying enough time to develop a new alloy that proved to be an adequate substitute [5]. But as many smaller companies cannot afford to engage in this level of recycling and/or substitutional research, a federal role in these areas could be critical to their competitiveness.

Terbium is an example of an element where changed recycling practices could have a dramatic effect on availability. It is used along with europium in color-balanced fluorescent lighting. Although minute quantities are used in each bulb, the world’s annual production of Tb is less than 0.5 MT, and it is in chronic undersupply: The price of Tb imported from China was nearly $800/kg in December 2010. When fluorescent lights are recycled, the metal ends are removed and recycled, and the glass is also reused. But the phosphor powder on the inside surface of the glass contains mercury, terbium, and other rare metals. Because mercury is toxic, current practice is to mix the powder into an aggregate compounded with concrete and sequester the concrete from the environment, thereby making the Tb unavailable for recycling.

Lastly, helium possesses a set of unique properties that make it special, even among the ECEs. Because it liquefies at the lowest temperature of all elements and does not solidify, it is indispensable for cryogenic applications. It is also the least chemically active element, cannot be rendered radioactive by exposure to radiation, and has the highest heat capacity of any gaseous element except hydrogen. These excellent thermal, chemical and nuclear properties make it the coolant fluid of choice for advanced nuclear reactor design. With such unique properties, He has already found use in unusual applications, and the breadth of its future utility is impossible to anticipate.

Other factors can complicate the availability of ECEs. Some are toxic, while others are now obtained in ways that produce unacceptable environmental damage. Discovery of new mineral deposits typically takes several years and the time between discovery and start-up of a new mine averages five to ten years [6]. For some elements, large-scale production may require development of new processing technologies, resulting in a time lag between increased demand and the availability of new supplies. Recycling and the existence of secondary markets is quite variable; for example, recycling is highly developed for platinum but is almost non-existent for most other ECEs, and hence significant quantities of ECEs are permanently discarded every year. Sometimes one element can be substituted for another in a technology, but more often than not substitution requires significant redesign, reengineering, and recertification with attendant delays.

A significant positive result of our study, however, is that, with the exception of helium, there does not appear to be any fundamental limit on the availability of any element for energy technologies in the foreseeable future. A practical limit on availability for a particular application will be reached when the material is no longer available at a competitive price, and while it can be anticipated that this will come to pass for some ECEs in the long term, we believe that the problems currently lie in short-term interruptions or constraints on supplies.

Recommendations

To deal with the multifaceted issue of ECE availability, the APS/MRS report makes an number of recommendations for U.S. federal action. The main recommendations are summarized here; full details appear in the report.

(1) Information Collection and Analysis

Collecting and evaluating data required to track the availability and uses of chemical elements is a complex undertaking. While some data are already collected by a number of federal agencies, there is no central entity for tracking minerals and processed materials over their life-cycle. The report recommends that the government should gather, analyze, and disseminate information on ECEs across the life-cycle supply chain, including discovered and potential resources, production, use, trade, disposal, and recycling. The entity undertaking this task should be a “Principal Statistical Agency”, a designation that would enable it to require compliance with requests for information. The Report also urges that the federal government regularly survey emerging energy technologies and the supply chain for elements, with the aim of identifying critical applications as well as potential shortfalls.

(2) Research and Development

The report recommends that the federal government establish a research and development effort focused on ECEs and possible substitutes that can enhance vital aspects of the supply chain, including geological deposit modeling, mineral extraction and processing, material characterization and substitution, utilization, manufacturing, recycling, and lifecycle analysis. Such a program would enable the U.S. to expand the availability of and reduce its dependence on ECEs, and could have the added advantage of enhancing the training of undergraduate, graduate, and post-doctoral students in disciplines essential to maintaining U.S. expertise in ECEs. Research on product designs that are more suited to recycling could help ensure that scarce elements are more easily recovered from discarded products, and research in chemical, metallurgical, and environmental science and engineering, and industrial design methods can help to create high-value reusable ECE materials.

(3) Efficient Use of Materials

The report urges that the federal government establish a consumer-oriented “Critical Materials” designation for ECE-related products. The certification requirements should include the choice of materials that minimize concerns related to scarcity and toxicity, the ease of disassembly, availability of appropriate recycling technology, and the potential for functional as opposed to non-functional recycling. Further, steps should be taken to improve rates of post-consumer collection of industrial and consumer products containing ECEs. The report also urges greater attention to material efficiency with the aim of producing necessary goods from as little primary material as possible. Beyond recycling, other aspects of efficient material use include improved extraction technology, reduced concentration in applications, replacement in non-critical applications, development of substitutes, and life-style adaptations.

(4) Market Interventions

With the exception of helium, the APS/MSR report does not advocate government interventions in markets beyond those implicit in the other recommendations concerning R&D, information gathering and analysis, and recycling. In particular, the report does not recommend non-defense-related economic stockpiles, as such stockpiles have had unintended disruptive effects on markets [2,7]. Industrial users of ECEs are best able to evaluate the supply risks they face and purchase their own “insurance” against supply disruptions caused by either physical unavailability or price fluctuations.

The single exception to this recommendation concerns helium, which is unique even among ECEs because it is permanently lost to the atmosphere if not captured during natural gas extraction. Helium is critical for current energy R&D and it is anticipated that it will be increasingly in demand in the future for technologies not yet developed. The report recommends that measures should be adopted to conserve and enhance the nation’s helium reserves.

(5) Federal Coordination

ECE availability is a complex topic that straddles a number of federal agencies including the Departments of Commerce, Defense, Energy, Homeland Security, Interior, State, and Transportation, the Environmental Protection Agency, the National Science Foundation, and the Office of the U.S. Trade Representative. The capacity to orchestrate a productive collaboration between these agencies and coordinate their efforts with the Office of Management and Budget lies in the Executive Office of the Science and Technology Policy (OSTP). Consequently, the report recommends that OSTP create a subcommittee within the National Science and Technology Council to examine the production and use of ECEs within the U.S. and to coordinate federal actions.

Summary and Conclusions

The importance of a spectrum of elements to both current and future national-scale energy technologies is well-established. Equally clear is that many of these elements are liable to future disruptions in supply due to scarcity, unpredictable geopolitical instabilities, and inefficient utilization. The APS/MRS report gives specific recommendations for governmental actions to address these issues. These recommendations fall within historically accepted roles for government: information gathering, support for research and workforce development, and incentives for select activities.

References and Notes

1. National Research Council: Minerals, Critical Minerals, and the U.S. Economy (National Academies Press, 2008).

2. Managing Materials for a Twenty-first Century Military (National Academies Press, 2008, 2008).

3. Critical Raw Materials for the EU (Ad-hoc Working Group on defining critical raw materials, European Commission, 2010).

4. Critical Minerals Strategy (U.S. Department of Energy, 2010)

5. P.J.Fink, J.L. Miller, D.G. Konitzer, J. of Minerals, Metals, and Materials Society 62, 57 (2010).

6. R.C. Schodde, J.M.A. Hronsky, in Wealth creation in the mineral industry — integrating science, business, and education, M.D. Doggett, J.R. Parry, Eds. (Soc. Of Economic Geologists, 2006), p. 71.

7. Selling the Nation’s Helium Reserve (National Academies Press, 2010).

Robert Jaffe, Physics, MIT, Cambridge, MA 02139

Jonathan Price, State Geologist, University of Nevada Reno, Reno, NV 89557

Murray Hitzman, Geology & Geological Engineering, Colorado School of Mines, Golden, CO 80401

Francis Slakey, APS and Georgetown University, Washington DC 20037

These contributions have not been peer-refereed. They represent solely the view(s) of the author(s) and not necessarily the view of APS.