Economic Performance Through Time: A Dynamical Theory

Dan Seligson, danielseligson@gmail.com

Why are there rich countries and poor, or colloquially, why do the haves have and the have-nots haven’t? Herodotus (Herodotus 440 BCE) wrote that civil war, worse than war among a united people, would bring a country to ruin. Aristotle (Aristotle 350 BCE) wrote that the Greeks’ political system and the bountiful life it bestowed was a product of its climate, neither too hot nor too cold, neither too wet nor too dry. And, can anyone have failed to notice that natural resources and geography contribute to prosperity? Nevertheless, quantitative assessment of the relative significance of these and other factors has been elusive. So the haves have and why the disparities of having are persistent are the central questions of Development Economics and Economic History, two disciplines whose names announce their common interest in economic performance through time. The prevailing view is that institutions—for instance the informal rules of social convention on the one hand, or transportation networks, health care systems, guilds, and formal legislation on the other—impose order, reduce transaction costs, and facilitate economic growth. Douglass North encapsulated this with an epigram, Institutions are the rules of the game, tipping his hat toward game theory as the means to characterize a dynamical system which he imagined lay beneath the observed world of economies evolving over time. If the 65,000 citations of his monograph Institutions, Institutional Change, and Economic Performance (North 1993) are any indication, the 1993 Nobel Prize winner has been influential. Yet, 50 years into the program of this so-called New Institutionalism, there is no game theoretic formulation of why the haves have, nor has any dynamical theory surfaced at all, a fact that he lamented in his Nobel acceptance speech to which he gave the title, Economic Performance Through Time. We address that deficit in this article, and in so doing, we show that institutions are not the rules of the game.1

North described the underlying dynamical system in persuasive prose; “Together with the standard constraints of economics, [institutions] define the choice set and therefore determine the transaction and production costs and hence the profitability and feasibility of engaging in economic activity. They evolve incrementally, connecting the past with the future; history in consequence is largely a story of institutional evolution in which the historical performance of economies can only be understood as a part of a sequential story.” Latent in these words is not game theory, but a pair of coupled, linear, first order differential equations whose solutions were fully explicated centuries ago.

Using to denote the economic performance of a polity i, and for its institutions as they are defined by North and others, we write

The argument, , of the differentiable functions f and g is a vector of exogenous factors that source (or sink) economic and institutional growth; for instance, climate, geography, natural resources, civil war, colonial history, and so forth. The constants and , both positive by definition, couple rather constrain and . By a transformation of scale, we may equate the couplings without loss of generality. The dissipations, and , again positive by definition, are the constraints on growth. Without dissipation, this model economy would be unstable, and real economies are not unstable, as we will confirm later. There is no a priori reason that , yet on the other hand, there is no reason for them to be much different. We ask the reader to accept that we have measured their ratio and found it to be unity.

Before we move on to the solution and validation of Eq. 1, let us take a look at . is a hodgepodge of slowly changing taboos and of laws that can change overnight. Defined in this way, is not suited for use in a time-dependent theory. If we are going to capture its full effect in the dynamical system, we must break it into components with different time dependences and follow them accordingly. We propose where , Institutions, are the infrastructure and systems of governance that evolve with the economy, and , Norms, are the ethics, codes of conduct, conventions, and unwritten rules of the game. Exploiting the fact that , equating the couplings and dissipations, and redefining such that , Eq. 1 becomes

Figure 1: The global economy in phase space, 1996-2016. 3210 observations of E, the UN’s Human Development Index and of I, the Worldwide Governance Index. Any theory of the global economy must have verisimilitude: it must predict the co-locality of “like-states”, the dominance of variance along the +1 sloping diagonal, and the persistence of this distribution. The theory described here demonstrates all three of these.

In this rewriting, Eq. 2 describes the motion of a polity in a phase space of and . Along the system eigenvectors and , the time constants are

The state flows to a fixed point if . If , then the coupling to the economy is imperceptibly small, and if , then the coupling is imperceptibly slow. Neither corner case provides the incentives for people to invest in the Institutions, therefore we argue that . What may we say about ? It is the size-dependent constraint on growth. The more infrastructure a polity possesses, the more maintenance it requires, lest that infrastructure decay to inutility. The bigger an economy, the harder it is to manage efficiently, therefore the greater the difficulty in growing. North estimated that the cost of institutions constituted a 40% tax on all transactions. Let us assume . Eq. 3 tells us that the time constants for convergence to are less than or equal to 10 years, a value that is small compared to the age of the global economy. So, not only is the motion converging, but theory says it has converged and that contemporary observations of are representative of the phase space equilibrium whose value is determined by f and g evaluated at the polity-specific and . Thus, is a dependent variable, equivalent in this sense to . Institutions are not the rules of the game. They are an outcome of the game.

If this is correct, then and measures of over time would be very nearly constant. Are they? Before we can answer that, we must put some flesh on the bones of and . For , we use the UN’s Human Development Index, HDI, a composite of currency-weighted income, life expectancy, and education. (UnitedNations 2019) For , we use the Worldwide Governance Index, the average of 5 Worldwide Governance Indicators collected by the World Bank. (Kaufmann 2019) In combination, these give us 3210 measurements of for 189 countries over the period 1996-2016, shown in Figure 1.

We digress briefly to note two significant features in the figure. First, we see that the variance is principally along the axis. Theory predicts the ratio of variances is for . The actual is 8.2. Second, we see that clusters of states that are geographically, climatically, and culturally alike are also economically and institutionally alike. Our theory teaches that the equilibrium condition, , depends only on polity-specific and . In as much as we expect that and are geographic, climatic, and cultural, our theory predicts that states of a feather flock to together; that is, it predicts regional homophilies.

Returning to the question of stability, if is the distribution of in a given year, then the autocorrelation function of tells us about the relative stability of . It is well approximated by the function where is the time interval in years and . We call the Persistence. Its half-life is over 300 years. It may be argued, especially by historians, that 20 years of phase data is insufficient to be making pronouncements about the wealth of nations over centuries. To that, we note that though we do not have long term data on governance as a measure of institutions, Leandro Escosura in Madrid has produced a time series of HDI over the period 1870 to 2015. (Escosura 2015) Examining the Persistence of this HDI, that is of only, we obtain and a half-life of nearly 500 years. Though we may speculate whether this 145-year time series tells us anything quantitative about the impact of the Industrial Revolution or of the Spanish or Islamic Conquests, it confirms the predictions based on the two most recent decades, and we assert that the distribution of polities in phase space has been stable over at least this past century. This persistence is consistent with Institutions not being the rules of the game. North’s epigram is an impediment to understanding persistence.

Since , we may write

(4)

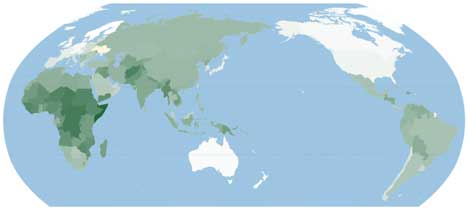

Figure 2: A world map of the global economy assessed by μ. The -component of 3025 observations of φ (Figure 1) is time averaged by country and represented here on a scale from low (dark green) to high (white).

This does not derive from a statistical correlation. It follows from the description of the underlying dynamics. It is a causal equation on the basis of which we may make causal queries of the data. (Pearl 2009) Though we don’t yet know the relevant and , we may construct an ensemble of models and interrogate them with the question, “The world is the best evidence of which among you?” If it turns out that the 3210 observations of are good evidence of a model based on geography and natural resources, Herodotus’s civil war, Aristotle’s climate, and some of our Norms, then we may say that we have made good progress towards solutions of the two central problems of Economic History, and that we have addressed North’s lament over the absence of a dynamical theory of economic performance through time. Here we report only on a two-factor model based on climate and geography.

In the 14th century, Ibn Khaldun identified latitude as a proxy for climate in the context of its contribution to social norms and the fortunes of Man. (Khaldun 2015) This was a practical choice in an era before geo-gridded databases. Today, we use the country-averaged, mean monthly high temperature over 1900-2016, a variable we call . (CRU 2018) The correlation of with PET, a measure of precipitation, evaporation, and transpiration, is 0.94, and so captures much relevant behavior of the water cycle. As for geography, we observe that elevation presents obstacles to a polity’s development of trade, agriculture, and human capital, suggesting mean elevation, h, as its proxy. Time averaging 3025 observations of in 177 countries, we get the map of Figure 2, and we approximate in the spirit of Eq. 4 to obtain

(5)

Not quite 50% of the global variance of is explained by these two variables. The t-statistic of each coefficient exceeds 7. Coefficients of second order terms, e.g., , which would signal an Aristotelian optimum, are insignificant.

How might we interpret this, notwithstanding the obvious truth that a bivariate model of the global economy is likely to suffer from omitted variable bias? is the sum of the quality of life (HDI) and the infrastructure of governance (WGI) under whose umbrella that life is lived. It is a measure of the total economy. HDI itself is the geometric mean of the log of Gross National Income, GNI, and of measures of education and longevity. This logarithmic contribution to HDI makes linear in log GNI, too, thus the coefficient of in Eq. 5 effects a 10% reduction in GNI per increase in , and the coefficient of h effects the same reduction for a 100-meter increase in mean elevation. In a still-under-development 6-variable model, , at the Bayes Information Criterion minimum, the revised coefficients for and h are -0.11/ (-7% GNI/) and -0.75/km (-5% GNI/100m), respectively, and their contribution to the observed variance of falls to about 20%. For comparison, we note that Dell, Jones, and Olken, in a study of the GDP of 134 countries, find an -8%/ variation, (Melissa Dell 2009) and Acemoglu, Johnson, and Robinson find a 0%/ variation in a very influential study of 40 countries, all of them former European colonies.(Daron Acemoglu 2002)3

The model , for which , suggests the potential for a Standard Model of the global economy. Imagine the mess we’d be in if a physicist had to generate her own model of the solar system every time she wanted to answer a question about planetary motions. A Standard Model is a much-needed institution that would create order in Development Economics and Economic History and reduce transaction costs in the policy and foreign aid worlds where tens of billions of dollars are spent annually on the basis of suspect or even provably wrong theory.

Conclusion

To social scientists, North’s epigram, Institutions are the rules of the game, is definitional. We construct a dynamical theory based on the more fundamental mechanism he posits, that of the co-evolution of institutions and the economy. That action of construction surfaces a problem with the definition of institutions, and its resolution upends the epigram itself. The theory generates a causal model of the total economy, obviating the prevailing understanding that all that separates Norway and Somalia is their Institutions. Rather, it follows that the addition of exogenous Institutions crowds out endogenous ones, leaving the total fixed at a level set by and . The high degree of verisimilitude between our theory and the global economy—and the absence of same between the New Institutionalism and the global economy—favors our understanding. Thus, though North Korea could become South Korea within a few decades, we see no path, short of global calamity, for Somalia to become Norway.

The colloquial definition of institutions fails us in dynamical theory. The success of even the toy model tells us that we are on a promising track with Eq. 2, and leads us to a new definition; Institutions are the humanly devised systems that promote economic growth, that are costly to build, costly to maintain, and that themselves scale with the economy. Thus, a law, for instance one ensuring property rights, is not itself an Institution, but an ever-revised code of laws with a judiciary and enforcement behind it is. Practically speaking, Institutions are growth-promoting infrastructure.

The theory presented here is simple and powerful, but elaboration is inevitable. Physicists have much to offer in this arena moving forward. For instance, on a theoretical level, we should look at international couplings. This might help us understand how civil war systematically affects a neighbor’s economy. At the modeling level, the observed linearity of over the full range of earthly is only possible if it is the sum of a multiplicity of factors, each of which operates over a smaller temperature range. This needs elucidation. The door is open for collaboration and perhaps even better, for independent scrutiny and approaches.

References:

Aristotle (350 BCE). Politics.

CRU (2018). High resolution gridded data sets.

Daniel Seligson, and Anne McCants, (2019) Economic Performance Through Time: A Dynamical Theory. ArXiv:1905.02956

Daron Acemoglu, S. J., James A Robinson (2002). "Reversal of Fortune: Geography and Institutions in the Making of the Modern WorldIncome Distribution." The Quarterly Journal of Economics 117(4): 1231-1294.

Escosura, L. P. d. l. (2015). World Human Development, 1870-2015.

Herodotus (440 BCE). Histories.

Kaufmann, D. (2019). "Worldwide Governance Indicators." from http://bit.ly/2F49GE3.

Khaldun, I. (2015). The Muqaddimah. Princeton, Princeton University Press.

Melissa Dell, B. F. J., Benjamin A. Olken (2009). "Temperature and Income: reconciling new cross-sectional and panel estimates." American Economics Review 99(2): 198-204.

North, D. C. (1993). Institutions, Institutional Change, and Economic Performance. New York, Cambridge University Press.

Pearl, J. (2009). Causality: Models, Reasoning, and Inference. New York, Cambridge University Press.

UnitedNations (2019). "United Nations Human Development Reports." from http://bit.ly/2TAVBIp.

[1] A longer version of this work with more thorough testing of its predictions is available on arXiv.org arXiv1905.02956. Daniel Seligson, Anne McCants. (2019) Economic Performance Through Time: A Dynamical Theory.

[2] Gross Domestic Product (GDP) is the most commonly used measure, but ordinal anomalies, for instance the near equivalence of GDP in Israel and Equatorial Guinea, make clear that it is not suitable for inter-polity comparisons.

[3] We will discuss the methodological shortcomings of the latter work in a forthcoming presentation at the 2019 Annual Meeting of the Social Science History Association.